President Donald Trump’s public ventures lost big money in 2025, while his personal fortune kept growing. Shares tied to his media firm fell sharply, and his $TRUMP token collapsed, even as major markets gained ground.

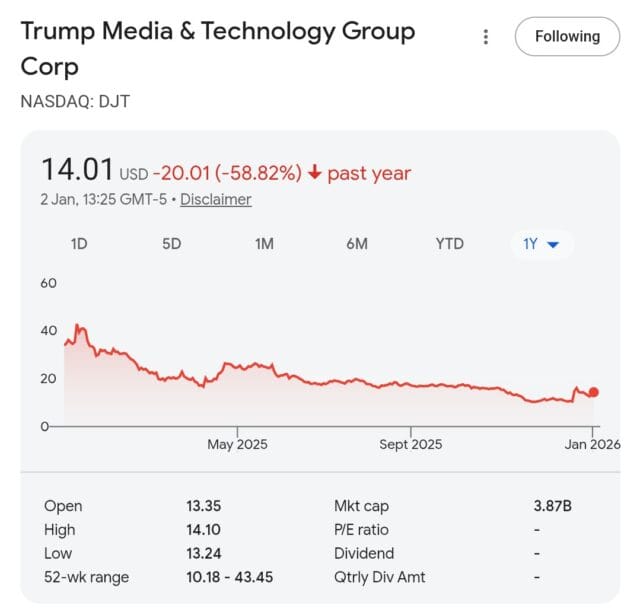

Trump Media and Technology shares fell about 58% from Jan. 19 through the end of the year, Axios reported. The drop was stark next to broad market gains for the year.

The $TRUMP memecoin also plunged, down roughly 89% from its post launch high. Axios noted the coin “now accounts for about 89% of Donald Trump’s net worth” at one point, a fact that helped drive huge gains for some insiders before prices fell.

Those losses came while the Nasdaq rose and parts of the wider market posted healthy returns. Journalists and analysts pointed out the odd contrast: some ticker symbols tied to the president lost value, while other indexes climbed.

Axios ran the numbers on hypothetical investments. It calculated that $1,000 placed in the Nasdaq at the start of the year would be worth about $1,184 by year end, while the same $1,000 in Trump Media would be worth about $331. The same comparison for crypto put $1,000 in the global cryptocurrency market cap at roughly $842, versus about $114 in $TRUMP.

Still, Forbes and other outlets tracked Mr. Trump’s personal finances and found his net worth rose sharply in 2025. Forbes reported that his estimated fortune grew from roughly $2.3 billion to about $5.1 billion over the year. That rise came largely from early token sales and other crypto related gains.

The Financial Times found the family enterprise pulled in large sums from crypto activity. The FT reported the Trump family’s crypto related operations generated more than $1 billion in revenue over the year, a haul that helped explain the gap between market losses for ordinary holders and gains for insiders.

That gap matters to everyday voters. A recent Politico survey found that nearly half of U.S. adults said the cost of living was “the worst they can ever remember it being.” The poll also reported that 37% of people who backed Mr. Trump in 2024 said the same thing. Those numbers underscore how financial pain among households can sit beside large gains for a small group.

Critics say the structure of the deals let insiders cash out while ordinary investors were left holding losses. Daniele Brian of the Project On Government Oversight called it “a blatant financial conflict of interest on behalf of the president … it is deepening his engagement in a world that raises real national security concerns.”

Academic critics made the point in blunt terms. David Krause said the project “pretty much excludes public investors or token holders from any meaningful financial participation,” and Jim Angel added, “It’s hard for me to see any economic benefit to the owner of these tokens.”

Lawmakers and regulators have started to ask questions about token sales, fees, and ties between public office and private money. Ethics experts say the mix of high finance and politics poses a test for rules meant to keep government separate from personal gain.

Featured image via google search screengrab